Are you looking for ways to maximize your investment returns while minimizing risks? Value stocks could be the answer you've been searching for. These stocks represent companies that are trading below their intrinsic value, offering investors a unique opportunity to buy low and sell high. At 5StarsStocks.com, we specialize in identifying and analyzing value stocks, helping investors like you make informed decisions. This comprehensive guide will explore the world of value investing, focusing on how 5StarsStocks.com can assist you in building a successful investment portfolio.

Value investing has been a proven strategy for decades, with legendary investors like Warren Buffett and Benjamin Graham demonstrating its effectiveness. By understanding what makes a stock a true value investment, you can position yourself to capitalize on market inefficiencies. Throughout this article, we'll examine how 5StarsStocks.com's expert analysis and research tools can help you identify the best value stocks available today.

Whether you're a seasoned investor or just starting your financial journey, understanding value stocks is crucial for long-term success. We'll explore various aspects of value investing, including key metrics to consider, common pitfalls to avoid, and how 5StarsStocks.com provides the resources you need to make smart investment choices. Let's dive into the world of value investing and discover how you can build wealth through strategic stock selection.

Read also:Did Chrissy And Jim Jones Have A Baby The Truth Behind The Rumors

Table of Contents

- Understanding Value Stocks: What Makes Them Special?

- Key Metrics and Analysis Tools for Value Investors

- 5StarsStocks.com Features and Resources

- Proven Value Investment Strategies

- Current Market Insights and Trends

- Risk Management in Value Investing

- Success Stories from 5StarsStocks.com Users

- Common Pitfalls to Avoid in Value Investing

- Building Long-Term Growth Through Value Stocks

- Future Outlook for Value Investing

Understanding Value Stocks: What Makes Them Special?

Value stocks represent companies that appear to be trading at a discount to their fundamental value. This discrepancy between market price and intrinsic value creates opportunities for investors to purchase shares at a bargain. Several characteristics distinguish value stocks from other investment options:

- Typically established companies with a proven track record

- Lower price-to-earnings (P/E) ratios compared to industry peers

- Strong balance sheets and consistent dividend payments

- Undervalued due to temporary market conditions or investor sentiment

When evaluating value stocks, investors should consider both quantitative and qualitative factors. The price-to-book (P/B) ratio, debt-to-equity ratio, and free cash flow are crucial metrics to analyze. Additionally, understanding a company's competitive position, management quality, and industry dynamics can provide valuable insights into its true value.

Why Value Investing Works

Value investing works because markets are not always efficient. Various factors, including investor psychology, market trends, and short-term news events, can cause stock prices to deviate from their intrinsic value. By identifying these discrepancies, value investors can purchase shares at a discount and potentially profit when the market corrects itself.

Key Metrics and Analysis Tools for Value Investors

Successful value investing requires a thorough understanding of various financial metrics and analysis tools. At 5StarsStocks.com, we provide comprehensive resources to help investors evaluate potential value stocks effectively.

Essential Financial Ratios

- Price-to-Earnings (P/E) Ratio: Measures a stock's current price relative to its earnings per share

- Price-to-Book (P/B) Ratio: Compares market value to book value of a company's assets

- Dividend Yield: Indicates the annual dividend payment as a percentage of stock price

- Debt-to-Equity Ratio: Assesses a company's financial leverage and risk profile

Understanding these metrics is crucial for identifying undervalued stocks. However, it's important to consider them in context and not rely on any single ratio alone. 5StarsStocks.com offers advanced screening tools that allow investors to filter stocks based on multiple criteria simultaneously.

5StarsStocks.com Features and Resources

5StarsStocks.com stands out in the investment research space through its comprehensive suite of tools and resources designed specifically for value investors. Our platform offers:

Read also:Roxanne Hoyle Height Unveiling The Truth Behind The Numbers

- Real-time stock screening and analysis tools

- Detailed company reports and financial statements

- Expert market commentary and analysis

- Customizable watchlists and portfolio tracking

Research and Analysis Tools

Our proprietary research tools provide investors with deep insights into potential value stocks. The platform's advanced algorithms analyze thousands of data points to identify undervalued opportunities. Users can access:

- Historical performance data

- Industry benchmark comparisons

- Technical analysis charts

- Fundamental analysis reports

All information is presented in an easy-to-understand format, making it accessible for both novice and experienced investors. The platform's user-friendly interface allows for seamless navigation between different research tools and resources.

Proven Value Investment Strategies

Successful value investing requires more than just identifying undervalued stocks. At 5StarsStocks.com, we recommend implementing proven strategies to maximize returns while managing risk:

- Diversify across sectors and market capitalizations

- Maintain a long-term investment horizon

- Regularly review and rebalance your portfolio

- Set clear entry and exit points for investments

One effective approach is the "margin of safety" concept, where investors purchase stocks at a significant discount to their estimated intrinsic value. This strategy provides a buffer against potential market downturns or incorrect valuations.

Portfolio Construction Techniques

Building a successful value portfolio involves careful consideration of various factors:

- Asset allocation based on risk tolerance

- Position sizing to manage risk exposure

- Correlation analysis between holdings

- Regular performance monitoring

5StarsStocks.com provides tools to help investors implement these strategies effectively, including portfolio optimization features and risk assessment metrics.

Current Market Insights and Trends

The value investing landscape is constantly evolving, influenced by various economic and market factors. Recent trends show:

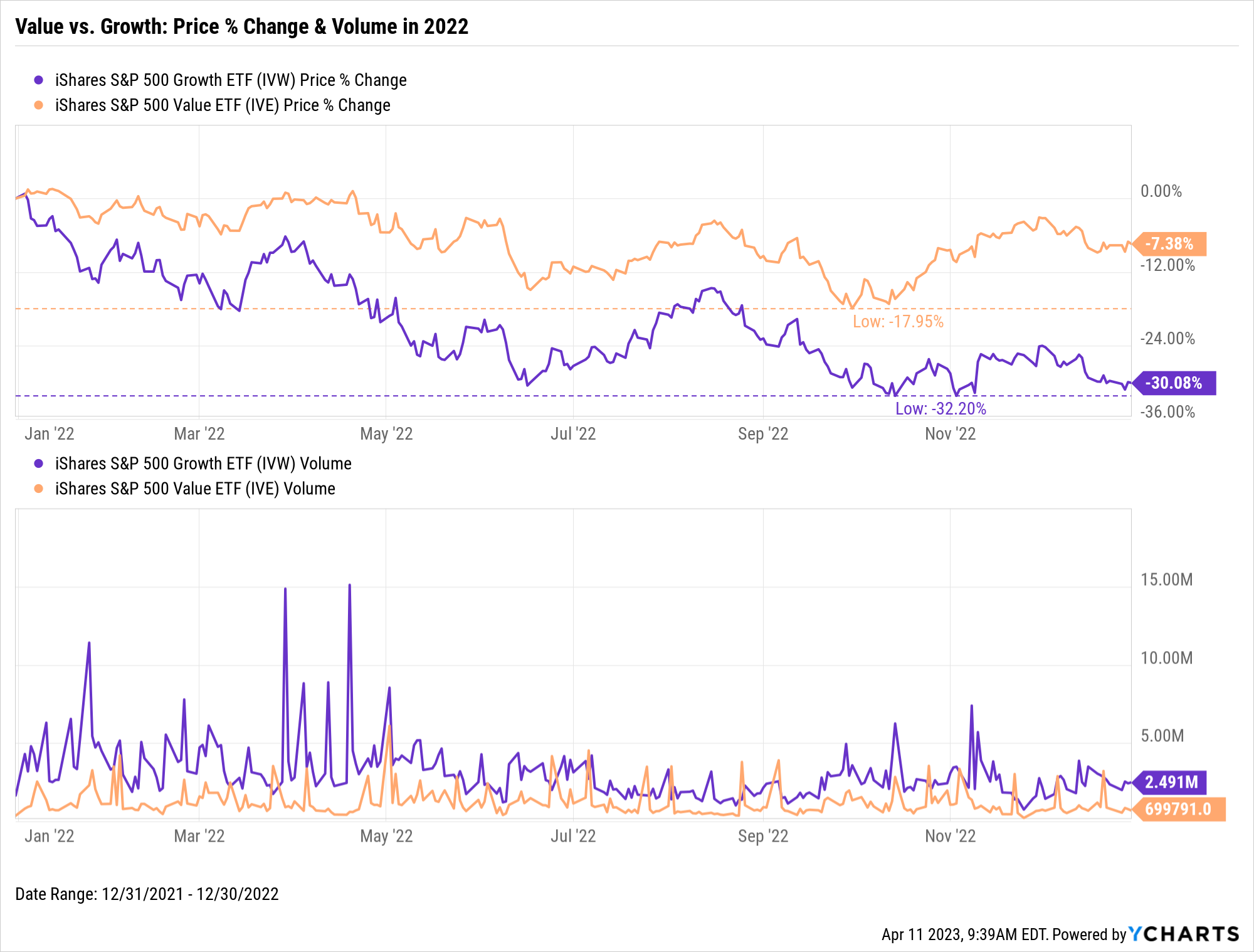

- Increased interest in value stocks following years of growth stock dominance

- Rising interest rates creating opportunities in traditionally undervalued sectors

- Technological advancements impacting traditional value metrics

- ESG considerations becoming more prominent in value analysis

5StarsStocks.com's market analysis team continuously monitors these trends, providing regular updates and insights to help investors stay informed. Our quarterly reports highlight sector-specific opportunities and emerging value themes.

Impact of Economic Cycles on Value Stocks

Different economic cycles present unique opportunities for value investors. Understanding these cycles can help investors time their investments more effectively:

- Recessionary periods often create buying opportunities

- Expansion phases may favor cyclical value stocks

- Interest rate environments impact valuation multiples

- Inflationary pressures affect different sectors variably

Risk Management in Value Investing

While value investing can be highly rewarding, it's crucial to implement proper risk management strategies. 5StarsStocks.com emphasizes several key risk mitigation techniques:

- Thorough due diligence before investment

- Position sizing and diversification

- Regular portfolio review and rebalancing

- Setting stop-loss orders and target prices

Understanding the difference between temporary price fluctuations and fundamental value changes is essential for successful value investing. Our platform provides tools to help investors monitor their positions and adjust their strategies as needed.

Common Risk Factors to Consider

Several risk factors can impact value investments:

- Market volatility and liquidity risks

- Industry-specific challenges

- Management and corporate governance issues

- Macroeconomic factors and geopolitical events

5StarsStocks.com's risk assessment tools help investors evaluate these factors and make informed decisions about their investments.

Success Stories from 5StarsStocks.com Users

Our platform has helped numerous investors achieve their financial goals through successful value investing. Here are some examples of how 5StarsStocks.com users have benefited from our resources:

- John D., a retail investor, increased his portfolio value by 45% in 18 months using our stock screening tools

- Sarah L., a financial advisor, improved her client returns by implementing our recommended value strategies

- Michael T., a retiree, successfully transitioned to a dividend-focused value portfolio with our guidance

These success stories demonstrate the effectiveness of our approach and the value we bring to investors at different stages of their financial journey.

Common Pitfalls to Avoid in Value Investing

While value investing offers significant potential, several common mistakes can hinder success:

- Overemphasizing low valuation metrics without considering quality

- Failing to account for changing industry dynamics

- Being too quick to sell during temporary market downturns

- Ignoring management quality and corporate governance

5StarsStocks.com provides resources and educational materials to help investors recognize and avoid these pitfalls. Our expert analysis often highlights potential red flags that investors might overlook.

Value Traps to Watch Out For

Not all low-priced stocks are value stocks. Some common characteristics of value traps include:

- Declining competitive position

- Deteriorating financial health

- Industry disruption or obsolescence

- Poor management decisions

Building Long-Term Growth Through Value Stocks

Value investing is inherently a long-term strategy that requires patience and discipline. At 5StarsStocks.com, we emphasize the importance of:

- Maintaining a consistent investment approach

- Regularly reviewing and adjusting portfolios

- Staying informed about market developments

- Adapting strategies to changing economic conditions

Successful value investors understand that market recognition of a stock's true value may take time. Our platform provides tools and resources to help investors stay committed to their long-term goals while remaining flexible enough to adapt to new opportunities.

Compounding Returns Through Value Investing

The power of compounding can significantly enhance returns in value investing:

- Reinvesting dividends to purchase additional shares

- Benefiting from multiple expansion as market recognizes value

- Capitalizing on dividend growth from established companies

- Building wealth through consistent portfolio appreciation

Future Outlook for Value Investing

As markets continue to evolve, value investing remains a relevant and effective strategy. Several factors suggest continued opportunities in value stocks:

- Technological advancements creating new value opportunities

- Increased focus on ESG factors influencing company valuations

- Market cycles favoring established companies with strong fundamentals

- Global economic shifts creating diverse investment opportunities

5StarsStocks.com is committed to helping investors navigate these changes and identify new value opportunities as they emerge. Our research team continuously monitors market developments and updates our resources to reflect the latest trends and insights.

Emerging Trends in Value Investing

Several trends are shaping the future of value investing:

- Integration of artificial intelligence in stock analysis

- Increased importance of