Are you looking for reliable investment opportunities in the stock market? Value stocks are an excellent choice for investors who want to maximize returns while minimizing risks. 5StarsStocks.com is a trusted platform that provides insights into high-quality value stocks, helping you make informed decisions. In this article, we will explore the concept of value stocks, why they matter, and how 5StarsStocks.com can guide you in identifying the best options for your portfolio. Whether you're a seasoned investor or just starting, this guide will equip you with the knowledge and tools to succeed. Let's dive into the world of value investing and uncover the potential of 5StarsStocks.com.

Value stocks are shares of companies that are considered undervalued compared to their intrinsic worth. These stocks often trade at lower prices due to temporary setbacks or market inefficiencies, making them attractive to investors seeking long-term growth. The appeal of value stocks lies in their potential to deliver significant returns once the market corrects its perception. However, identifying true value stocks requires expertise, research, and access to reliable data. This is where 5StarsStocks.com comes into play, offering curated insights and analysis to help investors navigate the complexities of the stock market.

5StarsStocks.com stands out as a trusted resource for value stock enthusiasts. With a focus on delivering accurate and actionable information, the platform ensures that investors can make decisions with confidence. In the following sections, we will delve deeper into the concept of value investing, explore the tools and resources available on 5StarsStocks.com, and provide actionable tips for selecting the best value stocks. By the end of this article, you'll have a comprehensive understanding of how to leverage value stocks for financial success.

Read also:How To View Private Tiktok Accounts A Comprehensive Guide

Table of Contents

- What Are Value Stocks?

- Why Invest in Value Stocks?

- How 5StarsStocks.com Works

- Tools and Resources on 5StarsStocks.com

- Key Factors to Consider When Selecting Value Stocks

- Case Studies of Successful Value Stock Investments

- Risks and Challenges of Value Investing

- Long-Term vs. Short-Term Value Investing

- Expert Tips for Maximizing Returns

- Conclusion

What Are Value Stocks?

Value stocks are shares of companies that are trading below their intrinsic value. These stocks are often overlooked by the market due to temporary issues, such as economic downturns, industry challenges, or negative publicity. However, savvy investors recognize that these dips in stock prices can present excellent buying opportunities. The key to identifying value stocks lies in understanding a company's fundamentals, such as its earnings, revenue growth, and competitive position in the market.

Investors who focus on value stocks often use metrics like the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to assess whether a stock is undervalued. For example, a low P/E ratio may indicate that a stock is trading at a discount compared to its earnings potential. Similarly, a high dividend yield can signal that a company is financially stable and committed to rewarding its shareholders. These metrics are essential tools for evaluating value stocks and are widely used by analysts on platforms like 5StarsStocks.com.

Characteristics of Value Stocks

Value stocks typically exhibit the following characteristics:

- Low price-to-earnings (P/E) ratio

- Strong balance sheets and stable cash flow

- Consistent dividend payments

- Undervaluation due to temporary market conditions

- Potential for long-term growth

By focusing on these attributes, investors can identify stocks that are likely to outperform the market once their true value is recognized.

Why Invest in Value Stocks?

Investing in value stocks offers several advantages, making it an attractive strategy for both novice and experienced investors. One of the primary benefits is the potential for significant returns. Since value stocks are often undervalued, they have room to grow once the market corrects its perception. This growth can lead to substantial profits for investors who buy these stocks at a discount.

Another advantage of value investing is its focus on fundamentals. Unlike speculative trading, which relies on short-term market trends, value investing emphasizes a company's intrinsic worth. This approach provides a level of stability and reduces the risk of losses due to market volatility. Additionally, value stocks often pay dividends, providing investors with a steady income stream while they wait for the stock price to appreciate.

Read also:Sweetie Fox The Ultimate Guide To The Rising Star In The Digital World

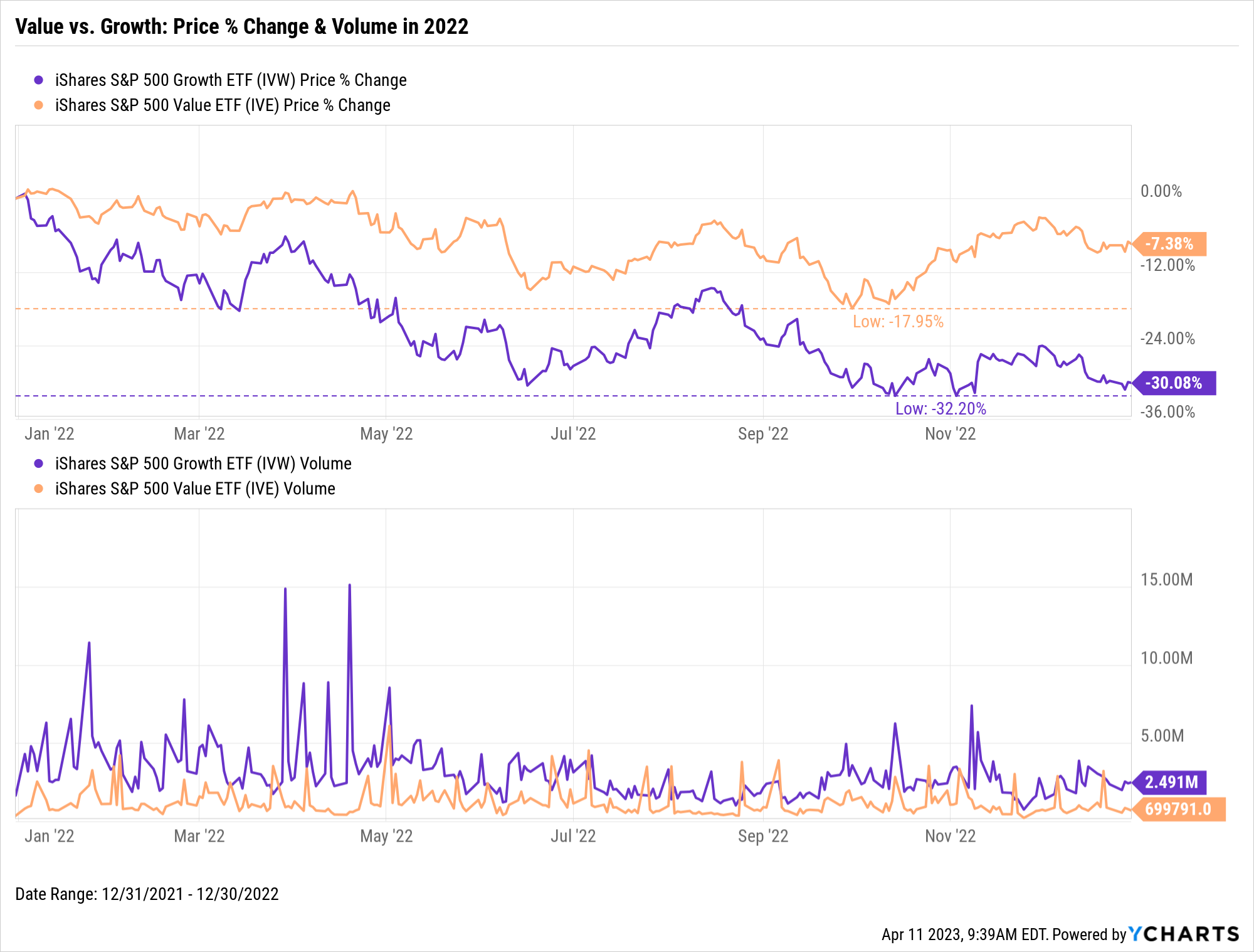

Comparing Value Stocks to Growth Stocks

While value stocks focus on undervalued companies, growth stocks are shares of companies expected to grow at an above-average rate compared to the market. Both strategies have their merits, but value stocks are generally considered less risky. Growth stocks often trade at high valuations, making them more susceptible to market corrections. On the other hand, value stocks offer a margin of safety, as their lower prices provide a cushion against potential losses.

How 5StarsStocks.com Works

5StarsStocks.com is a comprehensive platform designed to help investors identify and analyze value stocks. The platform uses advanced algorithms and data analytics to provide insights into market trends, company performance, and stock valuations. By aggregating data from reliable sources, 5StarsStocks.com ensures that investors have access to accurate and up-to-date information.

One of the standout features of 5StarsStocks.com is its user-friendly interface. Investors can easily search for value stocks based on specific criteria, such as industry, market capitalization, or dividend yield. The platform also offers detailed reports and analysis, helping users make informed decisions. Whether you're looking for long-term investments or short-term opportunities, 5StarsStocks.com has the tools to support your strategy.

Membership Benefits

5StarsStocks.com offers both free and premium membership options. Free users can access basic features, such as stock screeners and market news. However, premium members enjoy additional benefits, including:

- Exclusive stock recommendations

- Advanced analytics and charting tools

- Personalized investment advice

- Access to webinars and expert interviews

These features make 5StarsStocks.com a valuable resource for anyone looking to enhance their value investing strategy.

Tools and Resources on 5StarsStocks.com

5StarsStocks.com provides a wide range of tools and resources to help investors succeed. One of the most popular features is the stock screener, which allows users to filter stocks based on specific criteria. For example, you can search for value stocks with a low P/E ratio, high dividend yield, or strong earnings growth. This tool is invaluable for identifying potential investment opportunities.

In addition to the stock screener, 5StarsStocks.com offers detailed company profiles. These profiles include financial statements, key metrics, and analyst ratings, providing a comprehensive overview of each stock. Investors can also access market news and updates, ensuring they stay informed about the latest developments in the stock market.

Educational Resources

For beginners, 5StarsStocks.com offers a wealth of educational resources. These include articles, tutorials, and videos on topics such as value investing, stock analysis, and portfolio management. By leveraging these resources, investors can build their knowledge and confidence in navigating the stock market.

Key Factors to Consider When Selecting Value Stocks

Choosing the right value stocks requires careful consideration of several factors. One of the most important is a company's financial health. Investors should analyze key metrics such as revenue growth, profit margins, and debt levels to assess whether a company is financially stable. A strong balance sheet is a good indicator of a company's ability to weather economic challenges.

Another factor to consider is the competitive landscape. Companies operating in industries with high barriers to entry or strong market positions are more likely to succeed in the long run. Additionally, investors should evaluate a company's management team and track record. A competent and experienced leadership team can significantly impact a company's success.

Dividend Payments and Shareholder Value

Dividend payments are another important consideration when selecting value stocks. Companies that consistently pay dividends demonstrate financial stability and a commitment to rewarding shareholders. Investors should also look for companies with a history of increasing dividends, as this indicates strong earnings growth and a focus on shareholder value.

Case Studies of Successful Value Stock Investments

Examining real-world examples of successful value stock investments can provide valuable insights into the potential of this strategy. One notable case is the investment in Apple Inc. during the early 2000s. At the time, Apple was trading at a discount due to concerns about its product pipeline and competition. However, savvy investors recognized the company's strong fundamentals and potential for innovation, leading to significant returns as Apple's stock price soared.

Another example is the investment in Johnson & Johnson during the 2008 financial crisis. Despite the economic downturn, Johnson & Johnson's strong balance sheet and consistent dividend payments made it an attractive value stock. Investors who bought the stock during this period benefited from both capital appreciation and dividend income as the market recovered.

Lessons Learned

These case studies highlight the importance of patience and thorough research when investing in value stocks. While the initial returns may be modest, the long-term potential can be substantial. By focusing on fundamentals and maintaining a disciplined approach, investors can achieve success in value investing.

Risks and Challenges of Value Investing

While value investing offers many benefits, it is not without risks. One of the primary challenges is the potential for value traps. These are stocks that appear undervalued but are actually struggling due to fundamental issues, such as declining revenue or poor management. Investors must conduct thorough research to avoid falling into value traps.

Another risk is market volatility. Even the best value stocks can experience short-term price fluctuations due to external factors, such as economic downturns or geopolitical events. To mitigate this risk, investors should maintain a diversified portfolio and focus on long-term growth rather than short-term gains.

Overcoming Challenges

Despite these risks, value investing remains a viable strategy for building wealth. By using tools like 5StarsStocks.com, investors can access reliable data and analysis to make informed decisions. Additionally, maintaining a disciplined approach and staying focused on fundamentals can help investors navigate the challenges of value investing.

Long-Term vs. Short-Term Value Investing

Value investing can be approached from both a long-term and short-term perspective. Long-term value investors focus on buying undervalued stocks and holding them until their true value is realized. This strategy requires patience and a strong belief in a company's fundamentals. Over time, long-term investors can benefit from both capital appreciation and dividend income.

Short-term value investors, on the other hand, aim to capitalize on market inefficiencies by buying undervalued stocks and selling them once their prices rebound. This strategy requires a keen understanding of market trends and the ability to act quickly. While short-term value investing can be lucrative, it also carries higher risks due to market volatility.

Choosing the Right Approach

The choice between long-term and short-term value investing depends on an investor's goals, risk tolerance, and time horizon. Long-term investing is ideal for those seeking stable growth and income, while short-term investing is better suited for those willing to take on more risk for potentially higher returns.

Expert Tips for Maximizing Returns

To succeed in value investing, it's essential to follow best practices and leverage expert advice. One tip is to focus on industries with strong growth potential. For example, sectors like healthcare, technology, and renewable energy are expected to experience significant growth in the coming years, making them attractive targets for value investors.

Another tip is to diversify your portfolio. By investing in a mix of value stocks across different industries and market sectors, you can reduce risk and increase the likelihood of achieving consistent returns. Additionally, staying informed about market trends and economic developments can help you identify emerging opportunities.

Using 5StarsStocks.com Effectively

5StarsStocks.com is a powerful tool for value investors. To maximize its benefits, users should take advantage of its advanced features, such as stock screeners and analytics tools. By regularly reviewing the platform's recommendations and staying updated on market news, investors can make informed decisions and enhance their investment strategy.

Conclusion